Is The AI Trade Dead?

Michael Burry and Jim Chanos are sounding the alarm...

This is the hottest question in the market today.

The last few weeks have seen a dramatic shift in the narrative surrounding AI. Names that have led this rally including Oracle, CoreWeave, Nvidia, and many others have lost steam as the whispers of “bubble” get louder.

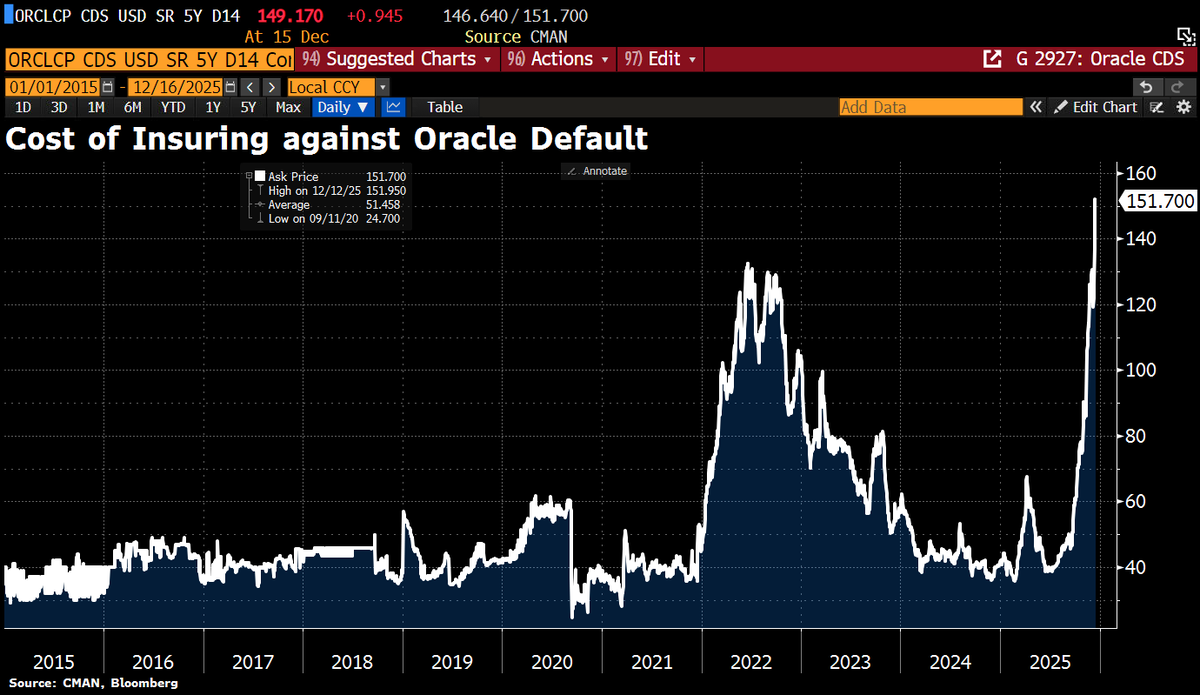

It feels like sentiment has been tipped in the complete opposite direction from where it was earlier this year. Now, many people are convinced and sure that AI is a bubble. The speculative euphoria that defined the last 2-3 years has shifted to skepticism and caution. Critics and high profile bears such as Jim Chanos and Michael Burry are sounding the alarm while widening Credit Default Swap (CDS) spreads for names like CoreWeave and Oracle continue to garner attention.

The fears currently dominating the headlines ranging from debt fueled expansion to the lack of immediate consumer side ROI are typical of the midpoint of every major technological revolution. Let me say, I do not think this is the “first inning” of the AI driven bull market. But I also don’t think were in the seventh inning either, rather somewhere in the middle. Peaks and valleys are normal. If you study history from the railroads of the 1800s to the fiber optic build out of the late 1990s the build typically always looks like a bubble right before it becomes the backbone of the global economy. Companies, governments, etc. would rather overspend than underspend.

In the remainder of this article I’m going to discuss whether I believe the AI trade is dead, which areas are most at risk, which areas may be presenting opportunity, what I believe the next phase of the AI trade is, which names to follow and put in your watchlist, and how I’m personally looking to position for it.

Let’s dive in.